However currently the GST portal is aligned to charge a late fee only on returns GSTR-3B. In case of transmission within a period of 1 month.

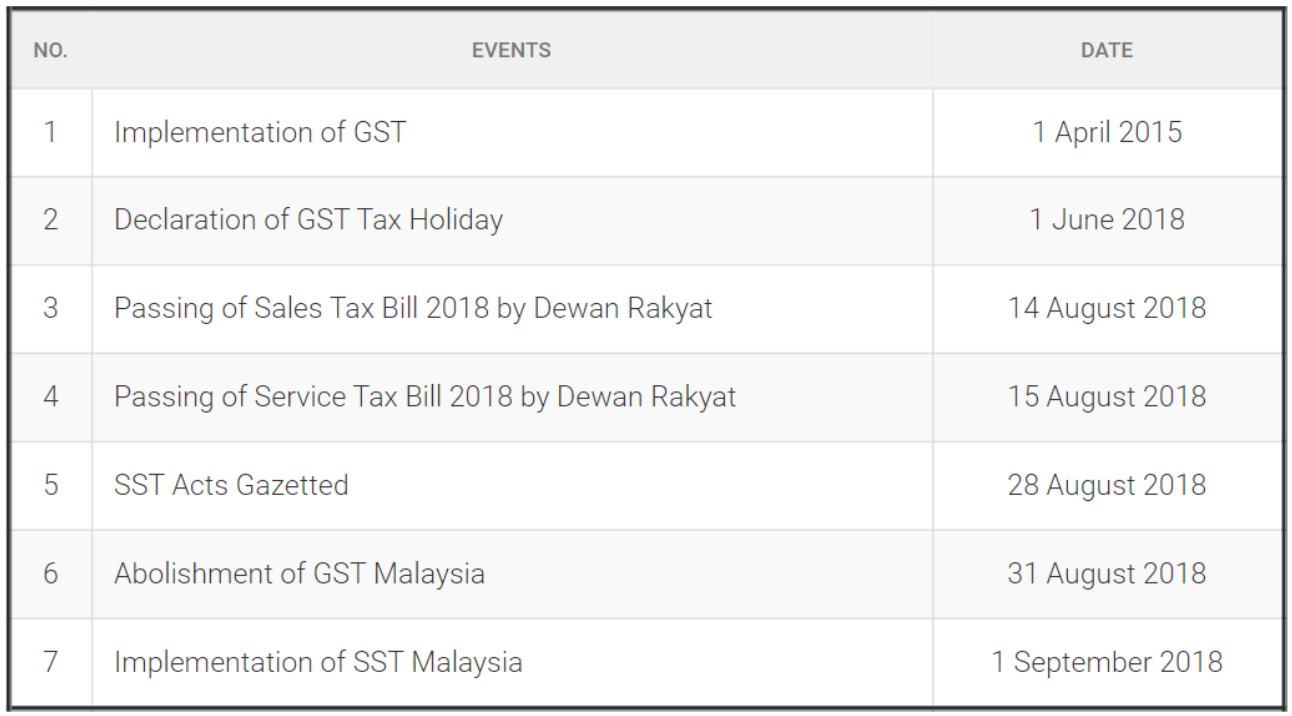

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

With effective from 1 January 2019 imported taxable service is subjected to service taxIn accordance with Section 2 of Service Tax Act 2018 imported taxable service means any taxable service acquired by any person in.

. The New Zealand Government has enacted the Goods and Services Tax GST legislation requiring certain businesses outside of New Zealand to apply a 15 GST on their sales of low-value goods imported to consumers in New Zealand starting from 1 December 2019. Deadline for submission of the relevant VAT return. Time Malaysia Time 24 September 2021 Friday 1000 am 600 pm.

Prior to 20 Feb 2018 the top marginal BSD rate for both residential and non-residential properties was 3. In case of share transfer within 1 month from the date of receipt of the instrument of transfer with the relevant document. The top marginal BSD rate for acquisition of residential properties on or after 20 Feb 2018 is 4.

A must-read for English-speaking expatriates and internationals across Europe Expatica provides a tailored local news service and essential information on living working and moving to your country of choice. Tax Treatment of LLP. The late fees will be calculated for a period of three days and must be paid in cash.

Applying approving verifying at ePCO will be functioning as usual. LLP have a similar tax treatment like Company where chargeable Income from LLP. We were unable to find any match for your search but here are some.

The late fee will depend upon the number of days of delay from the due date. Time limit for issuing Duplicate Share Certificate. Upon the submission and processing of the application forms we will conduct a site inspection at the location to verify the plumbing system of the premises.

Melayu Malay 简体中文 Chinese Simplified Guide to Imported Services for Service Tax Guide on Imported Taxable Services. Free press release distribution service from Pressbox as well as providing professional copywriting services to targeted audiences globally. Once payment has been made we will carry out meter installation work at your premises.

Companies from non-EU countries are allowed to submit a customs declaration only in very limited cases. However VAT deduction must be exercised under the. Largest selection for HP brands at lowest price.

This post is also available in. After the application process and inspection have been completed we will issue you a Deposit Bill and an Installation Bill. However you can deduct the import VAT in your VAT return.

Visit this page to find out the answers to some of the frequently asked questions you may have regarding AIA the product and services that we provide. The late fees will be calculated for three days and it should be deposited in cash. The late fee is calculated based on the number of days past the due date.

GST Return Late Fees. Melayu Malay 简体中文 Chinese Simplified Taxation for Limited Liability Partnership LLP in Malaysia. Payment options - COD EMI Credit card Debit card more.

Therefore in general the. GST return in GSTR-3B is filed on 23rd January 2021 3 days after the prescribed due date ie 20th January 2021. Got a question before or after youve bought an insurance plan.

Submission of the customs declaration by a representative such as a forwarding agent is permitted. In a listed company the certificate shall be issued within 15 days from the date of submission of the documents. With in-depth features Expatica brings the international community closer together.

RM3000 - audit confirmation on account as at a date which is no more than three 3 months from date of request ii RM5000 - audit confirmation on account as at a date which is between four 4 to twelve 12 months from date of request iii RM10000 - audit confirmation on account as at a date which exceeds twelve 12 months from date of. The importation is subject to import VAT in Europe. This post is also available in.

For e-Form D no ASW Activities will be. In practice a taxpayer that purchased and paid for a service in December 2017 and receives the invoice dated December 2017 in January 2018 can exercise the right of deduction only from the VAT settlement related to January 2018 and by 30 April 2019 ie. Expatica is the international communitys online home away from home.

With effect from 20 Feb 2018 there are differentiated BSD rates between residential and non-residential properties. HP Malaysias most complete online store for Laptops PCs Tablets Monitors Printers Inks Toners Workstations Accessories and more. During this period Malaysia will not be able to send and receive e-Form Ds ACDD and its related responses.

GST on Imported Low-Value Goods to New Zealand and Changes to Import Documentation. EPCO System normal operation will be not be impacted ie. The GSTR-3B GST return is due on the 23rd of January 2021 three days after the specified due date of the 20th of January 2021.

Newsletter 10 2018 Gst Tax Codes Part 2 Page 001 Jpg

Malaysia Sst Sales And Service Tax A Complete Guide

Gst In Malaysia Will It Return After Being Abolished In 2018

Malaysia Sst Sales And Service Tax A Complete Guide

Latest Gst Return Due Dates And Requirement To File Gstr 3b And Gstr 1

Gstn Enabled Two New Options In Form Drc 03 On Gst Portal A2z Taxcorp Llp

Sales And Service Tax Act 2018

Newsletter 14 2018 Part Iii Upcoming Amendment To The Gst Regulations Fifth Schedule In Relation To Form Gst 03 Page 001 Jpg

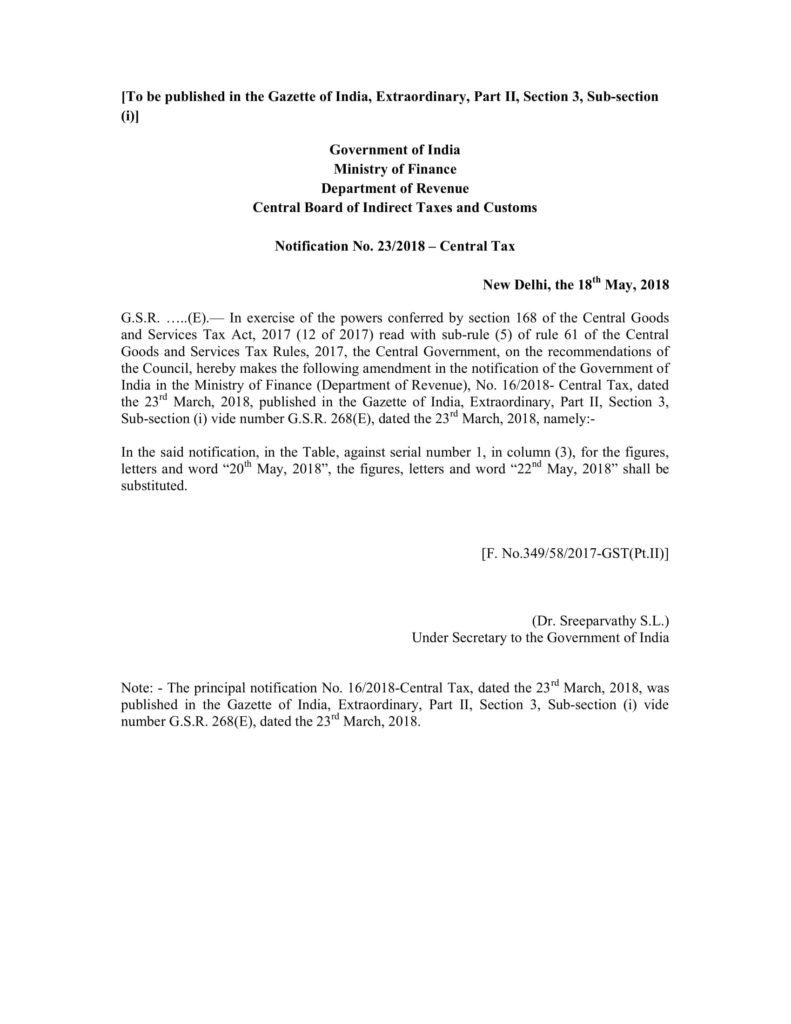

Extension Of Due Date Of Filing Of Form Gstr 3b April 2018 Ebizfiling

Gst Submission Of Final Gst Return Estream Software

Gst In Malaysia Will It Return After Being Abolished In 2018

Malaysia Scrapping Gst From June 2018 Solarsys

Due Dates For Gst Returns Types Of Gst Returns Ebizfiling

Newsletter 67 2018 Information Required For Extension Of Time To Account For Gst Output Tax Page 001 Jpg

Newsletter 22 2019 Gst Guide On Transition Issue Page 001 Jpg